PLANNED GIVING

Leaving a Legacy Through Planned Giving

Planned Giving is an increasingly attractive alternative which can benefit you, the hospital and future generations. Planned Giving is a long-range approach to supporting the Palmerston & District Hospital through the Foundation. It has the potential to offer you significant tax benefits while maintaining financial security for you and your family, and the ability to make a larger gift that might otherwise not be possible. Planned Giving offers the Palmerston & District Hospital a measure of security, a life long relationship with donors and an enhanced capability to undertake larger scale projects.

A Planned Gift is one that is promised now but often is not realized until some time in the future. These gifts include bequests, life insurance policies, marketable securities, annuities and real estate. Each of these gifts offers the potential for significant tax advantages. Your support will enhance the Foundation's ability to help provide high quality health care our community deserves and expects.

Bequest

+

A will is the most important vehicle for making financial provisions for our loved ones and ensuring that your wishes are known. A major benefit in making a bequest gift is that while you have arranged a gift to the hospital and have the satisfaction of knowing that it is in place, you retain control of the funds throughout your lifetime. Upon your death, the gift will be transferred to the Foundation and a tax receipt will be issued which we then reduce the amount of tax owing on your estate. A bequest can take the form of cash, real estate or other valuables such as stocks, bonds or guaranteed income certificates.

Real Estate

+

A gift of real estate opens the possibility of a large gift without using liquid assets. A gift of real estate makes it possible for you to make an immediate gift, and receive an immediate charitable receipt. A gift of real estate can take two options. First, an outright gift would result in a tax receipt for the fair market value of your property. The second option would be if you chose to give the gift of your property but retain the right to reside in the home. Such a gift requires that the property be irrevocably transferred to the Foundation. In this case, you would continue to pay all costs related to the property. However, you would receive a tax receipt for the fair market value of your committed gift while you are alive. The actual transfer of the property occurs when you choose.

Life Insurance Policy

+

A life insurance policy is an easy and uncomplicated way to make a Planned Gift. As the owner/beneficiary of the policy is the Palmerston & District Hospital Foundation, the insurance proceeds at death are not included in the value of the estate thereby reducing probate fees otherwise payable by the estate. A new policy can be purchased and assigned to the Foundation as the owner and beneficiary. You will receive tax receipts for the annual premiums that you pay. An existing policy ownership can be transferred to the Foundation and a tax receipt will be issued for the cash surrender value, plus each subsequent premium payment you make. In both cases, immediate tax benefits will be realized.

Annuity

+

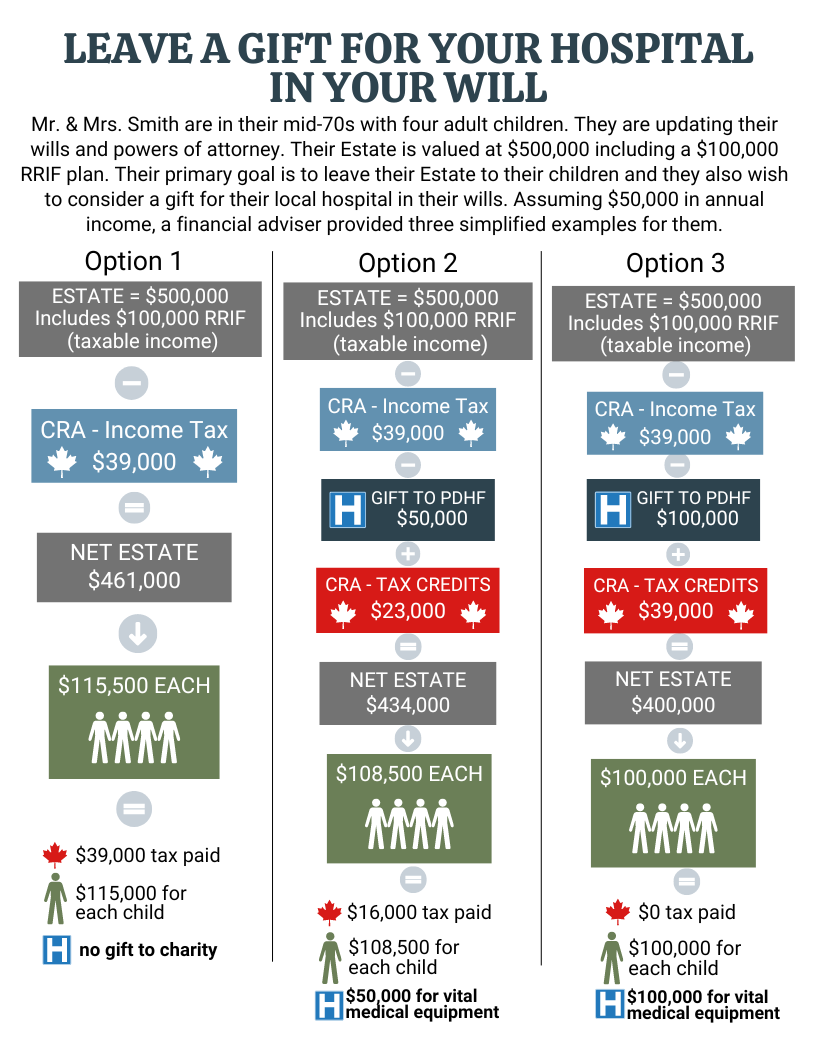

The following graphic shows how your estate could benefit from planned giving.

When arranging a Planned Gift you should be sure to consult with your own legal and financial advisors about the applicability of your situation.